In India, small-cap stocks, which are generally classified as firms with a market value below ₹5,000 crore, provide discriminating investors with attractive long-term wealth development potential, according to SEBI. These companies are generally smaller than mid-cap and large-cap firms and may offer significant growth potential, ranking below the top 500 corporations in terms of free-float market capitalization. Growth, innovation, and structural tailwinds can propel these companies to provide disproportionate returns over the long term.

Why small caps matter:

- High growth potential: These businesses may outperform their large- and mid-cap counterparts by growing revenues and earnings at double-digit rates while having relatively modest bases.

- Undervaluation opportunities: Despite having solid fundamentals, many tiny caps trade at fair prices due to a lack of analyst attention.

- Sectoral and domestic tailwinds: Small and agile businesses gain disproportionately from India’s industrial revival, infrastructure investments, digitization, and consumption upturn.

However, small caps carry heightened risks:

- Volatility: They often see more dramatic price swings tied to sentiment and liquidity.

- Balance sheet concerns: Some may hold high debt or be undercapitalized.

- Limited transparency: Governance and disclosure levels may lag behind those of larger companies.

This is best suited for patient investors who are prepared to research individual names, have a medium- to long-term view (≥5 years), and are comfortable with volatility. Although novices can acquire tiny stocks through mutual funds or SIPs with a small-cap theme, they should nonetheless prioritize value discipline and portfolio diversification.

In this edition, we profile 10 small-cap gems that blend growth, profitability, and reasonable valuation, anchored in India’s 2025 economic narrative: rising consumption, Make‑in‑India acceleration, and emerging fintech/disruption.

10 Best Small-Cap Stocks in India

S.No. | Name | Market Cap (₹ Cr) | P/E | Div Yield (%) | ROE (%) | Debt/Equity | 1Y Return (%) |

1 | Gravita India | 13,425.05 | 39.74 | 0.35 | 21.49 | 0.14 | 6.86 |

2 | Sakar Healthcare | 774.72 | 39.13 | 0.00 | 6.40 | 0.26 | 7.46 |

3 | SG Mart | 3,731.65 | 38.88 | 0.00 | 8.22 | 0.58 | -8.50 |

4 | Aurionpro Sol. | 7,470.91 | 38.63 | 0.07 | 15.30 | 0.02 | -16.21 |

5 | Newgen Software | 12,080.94 | 38.06 | 0.59 | 22.50 | 0.04 | -20.85 |

6 | Waaree Renewab. | 10,859.88 | 37.36 | 0.10 | 64.95 | 0.06 | -39.79 |

7 | SML ISUZU | 5,193.69 | 36.51 | 0.50 | 36.41 | 0.85 | 75.58 |

8 | JTL Industries | 2,848.65 | 33.92 | 0.17 | 9.92 | 0.04 | -29.62 |

9 | Amal | 1,205.54 | 31.52 | 0.10 | 34.65 | 0.00 | 166.80 |

10 | Krishana Phosch. | 3,115.43 | 30.93 | 0.10 | 25.29 | 0.98 | 85.51 |

In-Depth Look at the 10 Best Small-Cap Stocks

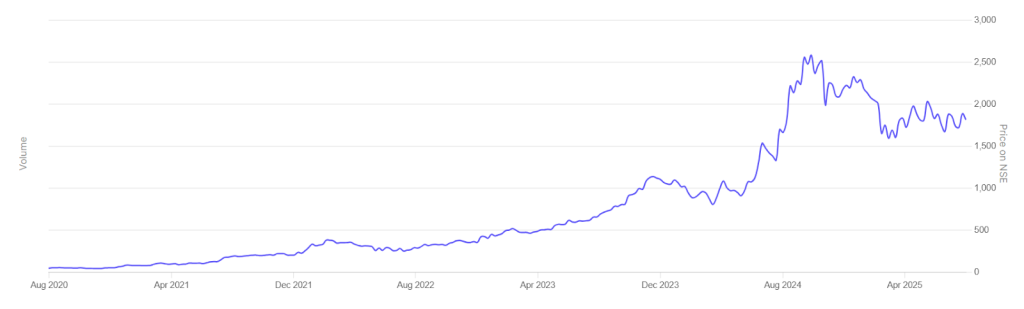

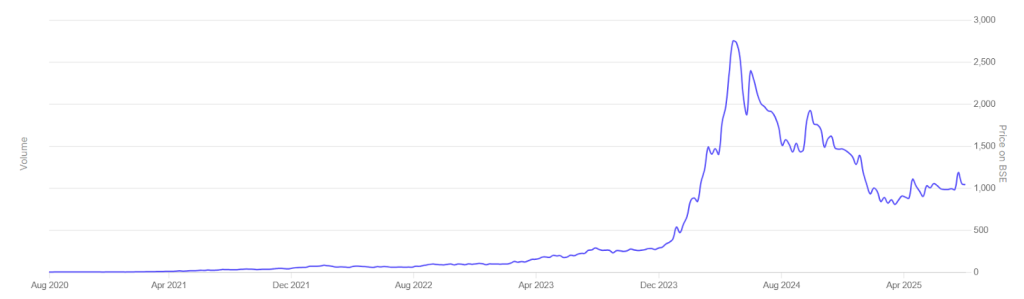

1. Gravita India

With operations in more than 70 countries, Gravita is a major worldwide recycler with a focus on lead, aluminum, plastics, and rubber. It is well-positioned in a world shifting toward circular economy solutions because of its vertically integrated business strategy and involvement in vital supply chains like batteries and power lines. But because it works in a commodity-sensitive sector, fluctuations in the price of metal and scrap may have a significant impact on profits. Other persistent issues are growing working capital cycles and changes in environmental regulations.

Company Snapshot

Founded: 1992

Headquarters: Jaipur, Rajasthan

Current MD: Rajat Agrawal

Segment: Metals & Recycling

Fundamentals

CMP – ₹1,815

Market Cap – ₹13,425 Cr

P/E Ratio – 39.74

ROE – 21.49%

Net Profit (Quarterly) – ₹93.06 Cr

Debt-to-Equity – 0.14

1-Year Return – 6.86%

7-Year Return – 42.73%

2. Sakar Healthcare

Sakar Healthcare is a small-cap pharmaceutical company engaged in the formulation and manufacturing of various dosage forms. It has expansion potential but currently delivers modest returns.

Company Snapshot

Founded: 2004

Headquarters: Ahmedabad, Gujarat

Current MD: Jatin Patel

Segment: Pharmaceuticals

Fundamentals

CMP – ₹352.95

Market Cap – ₹775 Cr

P/E Ratio – 39.13

ROE – 6.40%

Debt-to-Equity – 0.26

1-Year Return – 7.46%

7-Year Return – 30.42%

3. SG Mart

SG Mart is a retail or consumer-facing business, likely operating in smaller towns and cities. Despite past multiyear returns, the recent decline and debt load may concern cautious investors.

Company Snapshot

Founded: Not widely known

Headquarters: India

Current MD: Not specified

Segment: Retail / Consumer Goods

Fundamentals

CMP – ₹332.05

Market Cap – ₹3,731 Cr

P/E Ratio – 38.88

ROE – 8.22%

Debt-to-Equity – 0.58

1-Year Return – -8.50%

7-Year Return – 81.09%

4. Aurionpro Solutions

Aurionpro uses a robust IP-led business strategy to provide clients worldwide with digital banking and fintech solutions. Concerns include high valuation, minimal promoter holding, and reliance on high-priced acquisitions despite steady growth.

Company Snapshot

Founded: 1997

Headquarters: Navi Mumbai, Maharashtra

Current CEO: Ashish Rai

Segment: IT / Fintech Solutions

Fundamentals

CMP – ₹1,348.20

Market Cap – ₹7,470 Cr

P/E Ratio – 38.63

ROE – 15.30%

Debt-to-Equity – 0.02

1-Year Return – -16.21%

7-Year Return – 46.84%

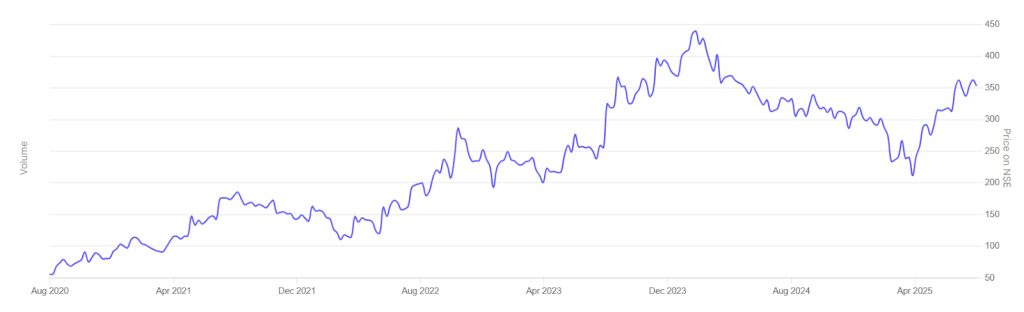

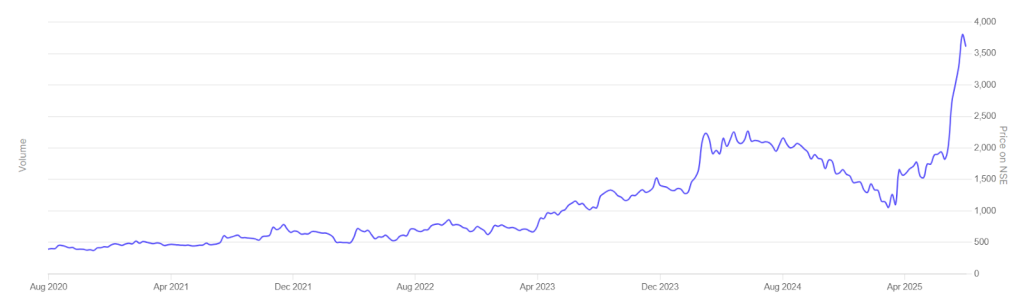

5. Newgen Software

Newgen is a domestic business software company that provides low-code development, digital transformation tools, and AI-driven process automation through its NewgenONE platform. With customers in more than 70 nations, it is establishing a niche in sectors including government, banking, and insurance. Its high valuation, however, sets a high standard for performance. Additionally, competing with well-funded multinational software behemoths is a consequence of worldwide expansion, particularly in Western countries, which increases the risks of both execution and competition.

Company Snapshot

Founded: 1992

Headquarters: New Delhi

Current MD & CEO: Diwakar Nigam

Segment: IT Products / Enterprise Automation

Fundamentals

CMP – ₹853

Market Cap – ₹12,081 Cr

P/E Ratio – 38.06

ROE – 22.5%

Debt-to-Equity – 0.04

1-Year Return – -20.85%

7-Year Return – 32.43%

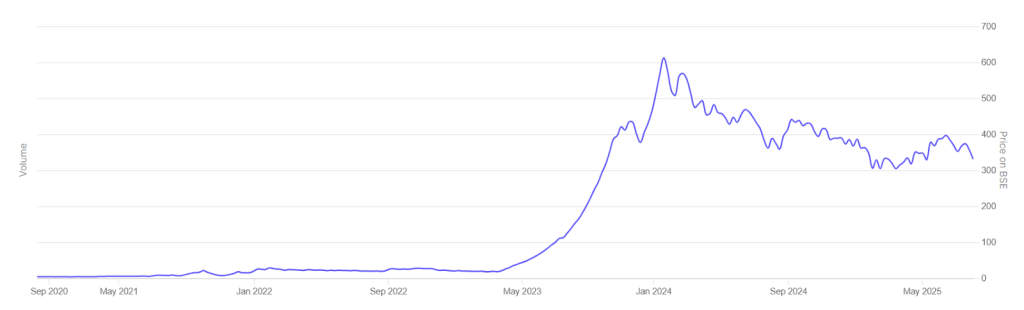

6. Waaree Renewable Technologies

Waaree is a renewable energy company specializing in solar EPC projects. It enjoys exceptional ROE and is well-positioned in India’s clean energy transition, despite recent price volatility.

Company Snapshot

Founded: 1999 (Group)

Headquarters: Mumbai, Maharashtra

Current CEO: Hitesh Doshi (Waaree Group)

Segment: Renewable Energy / Solar EPC

Fundamentals

CMP – ₹1,041.70

Market Cap – ₹10,860 Cr

P/E Ratio – 37.36

ROE – 64.95%

Debt-to-Equity – 0.06

1-Year Return – -39.79%

7-Year Return – 119.52%

7. SML ISUZU

SML Isuzu manufactures commercial vehicles in partnership with Isuzu, Japan. With a strong post-COVID recovery and robust ROE, it’s riding India’s infra-led growth, albeit with high leverage.

Company Snapshot

Founded: 1983

Headquarters: Chandigarh

Current MD & CEO: Atsushi Ogihara

Segment: Commercial Vehicles

Fundamentals

CMP – ₹3,609.50

Market Cap – ₹5,194 Cr

P/E Ratio – 36.51

ROE – 36.41%

Debt-to-Equity – 0.85

1-Year Return – 75.58%

7-Year Return – 24.35%

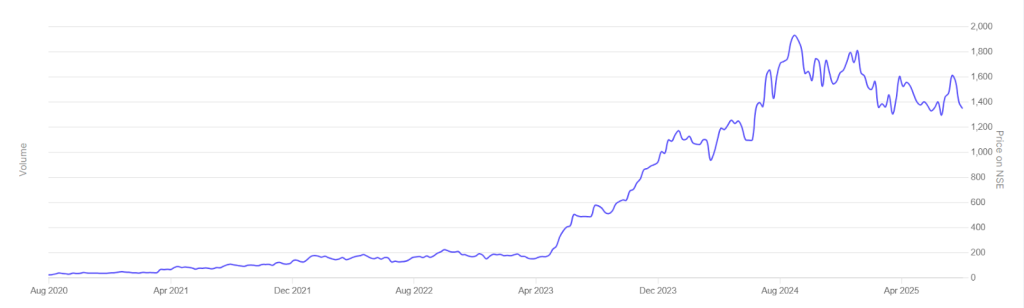

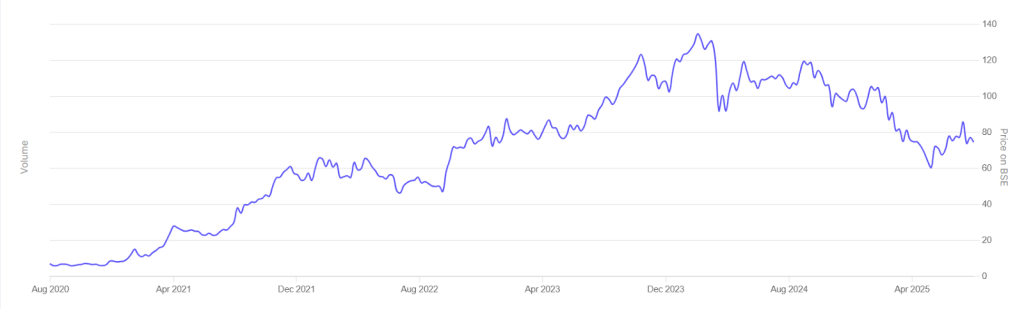

8. JTL Industries

Supplying industries including solar, water infrastructure, and real estate, JTL Industries is a major participant in the structural steel tube and ERW pipe market. Its broad range of products and nationwide presence are significant advantages. Nonetheless, its operations are closely related to the cycle of infrastructure and construction. Execution risk is increased by growing working capital requirements, constraints on input costs, and fierce rivalry from bigger competitors.

Company Snapshot

Founded: 1991

Headquarters: Chandigarh

Current MD: Abhishek Gupta

Segment: Steel & Infrastructure Components

Fundamentals

CMP – ₹74.69

Market Cap – ₹2,849 Cr

P/E Ratio – 33.92

ROE – 9.92%

Debt-to-Equity – 0.04

1-Year Return – -29.62%

7-Year Return – 40.24%

9. Amal Ltd

Amal Ltd, part of the Atul Group, is a small-cap specialty chemicals manufacturer. It boasts a debt-free balance sheet and one of the highest ROEs in its segment.

Company Snapshot

Founded: 1974

Headquarters: Gujarat

Current MD: R.R. Barvalia

Segment: Specialty Chemicals

Fundamentals

CMP – ₹975.15

Market Cap – ₹1,206 Cr

P/E Ratio – 31.52

ROE – 34.65%

Debt-to-Equity – 0.00

1-Year Return – 166.80%

7-Year Return – 32.80%

10. Krishana Phosphates

Krishana Phoschem supplies fertilizers and intermediates like H-acid to important downstream companies, straddling the agrochemical and dyes sectors. Although it has growth levers due to its dual exposure to chemicals and agriculture, its fortunes are nevertheless closely tied to commodity inputs and government price regulations. The risk profile is completed by cyclicality, high values, and difficult inventory management.

Company Snapshot

Founded: Not publicly available

Headquarters: India

Current MD: Not specified

Segment: Agrochemicals / Fertilizers

Fundamentals

CMP – ₹514.50

Market Cap – ₹3,115 Cr

P/E Ratio – 30.93

ROE – 25.29%

Debt-to-Equity – 0.98

1-Year Return – 85.51%

7-Year Return – 60.81%

Conclusion

Over time, small-cap stocks have rewarded disciplined, long-term investors in India with high growth and wealth compounding—but only when backed by fundamentals, not hype. The 10 names profiled above combine:

- Structural tailwinds: infrastructure, digital, exports, consumption

- Financial strength: ROE >15%, manageable debt, consistent growth

- Valuation comfort: mostly near-average P/E, avoiding bubbles

- Institutional interest: held by leading mutual funds and analysts

That said, small caps are not for the faint-hearted—expect volatility, sector disruptions, and execution risk. Instead of betting on one “bluebird,” consider building a diversified small-cap bucket of 5–7 names, supplemented by mid/large caps.

Key investment rules:

- Diversify across sectors—don’t over-allocate to one theme (e.g., infrastructure or consumer).

- Valuation discipline—focus on P/E, P/B, ROE relative to historical ranges.

- Regular monitoring—track quarterly earnings, promoter pledging, and balance-sheet health.

- Maintain a 5–7 year investment horizon—to ride cycles and realize compounding.

With the right mix of fundamentals, patience, and portfolio risk control, small caps can become the growth engine of your sovereign wealth portfolio.