In the vast and ever-evolving landscape of the Indian stock market, midcap stocks often strike a sweet spot between stability and high growth potential. But what exactly are midcap stocks, and why do they matter to long-term investors?

Midcap stocks refer to publicly listed companies with a market capitalization typically ranging between ₹5,000 crore and ₹20,000 crore. These companies are neither fledgling startups nor corporate behemoths—they sit comfortably in the middle, often exhibiting both maturity and the potential to grow exponentially.

In India, the mid-cap space is brimming with businesses that are future-ready, innovation-driven, and poised to become tomorrow’s blue-chip giants. For retail investors, particularly those with a moderate risk appetite and a long-term horizon, midcaps offer a compelling proposition. They can deliver substantial returns as they move up the value chain and gain market share.

In this blog, we’ll dive deep into the world of midcaps, understand their pros and cons, explore how to pick the right ones, and walk you through a curated list of ten of the best midcap stocks for long-term investment in India.

Why Consider Midcap Stocks for Long-Term Investment?

Midcaps are often likened to the ‘growth engines’ of the stock market. Unlike large caps that have already captured significant market share or small caps that may lack financial strength, midcap companies offer a unique mix of resilience and headroom for growth.

The Growth Advantage

Midcap companies are typically in the expansion phase of their lifecycle. This means they’re actively innovating, acquiring customers, expanding distribution, and tapping into new markets. As India’s economy grows and diversifies, many of these companies are well-positioned to ride multiple structural tailwinds—from digitization and urbanization to manufacturing and exports.

Balanced Risk-Reward Equation

Yes, midcaps are riskier than their large-cap counterparts. But with sound selection and a long-term perspective, the risk can be significantly mitigated. Historical data shows that quality midcaps have outperformed broader indices over longer periods, rewarding patient investors handsomely.

Portfolio Diversification

Investing in midcaps ensures better diversification, especially if your portfolio is heavily skewed toward large caps or index-based instruments. A blend of large, mid, and small caps allows you to optimize both risk and return.

Benefits and Risks of Investing in Midcap Stocks

Benefits

- High Growth Potential: Midcap companies have room to grow and expand, making them attractive for long-term capital appreciation.

- Innovation and Agility: Midcaps tend to be more agile and innovative, adapting quickly to changing market dynamics.

- Valuation Advantage: Compared to large caps, midcaps are often undervalued, providing better entry points.

- Diversification: Investing in midcaps adds a diversification layer to a portfolio dominated by blue-chip stocks.

Risks

- Market Volatility: Midcaps are generally more volatile than large caps and may face steeper declines during market downturns.

- Limited Liquidity: Trading volumes can be lower, leading to difficulty in executing large trades.

- Execution Risk: While many midcaps have potential, not all succeed. Business execution risks remain.

- Regulatory Sensitivity: Changes in government policy or regulation can disproportionately affect midcap players.

10 Best Midcap Stocks

S.No. | Name | Market Cap (Rs. Cr.) | P/E | Div Yld (%) | ROE (%) | Debt/Equity | 1Yr Return (%) |

1 | CDSL | 31,826.52 | 64.35 | 0.60 | 32.68 | 0.00 | 31.98 |

2 | Garden Reach Sh. | 28,576.02 | 54.11 | 0.36 | 28.11 | 0.00 | 16.34 |

3 | Tata Elxsi | 37,582.47 | 50.37 | 1.21 | 29.27 | 0.07 | -12.92 |

4 | Astrazeneca Phar | 22,317.65 | 127.44 | 0.36 | 23.63 | 0.05 | 23.63 |

5 | Ajanta Pharma | 34,433.52 | 37.03 | 1.31 | 24.91 | 0.01 | 15.22 |

6 | Apar Industries | 34,944.41 | 42.54 | 0.56 | 19.60 | 0.13 | 9.53 |

7 | Hexaware Tech. | 45,053.54 | 34.02 | 0.79 | 23.29 | 0.10 | — |

8 | Dr Lal Pathlabs | 25,575.83 | 52.31 | 0.77 | 24.30 | 0.07 | -0.05 |

9 | L&T Technology | 44,844.64 | 35.42 | 1.27 | 22.11 | 0.10 | -19.05 |

10 | Blue Star | 35,776.97 | 61.12 | 0.52 | 20.62 | 0.12 | 1.97 |

Deep Dive into 10 Best Midcap Stocks

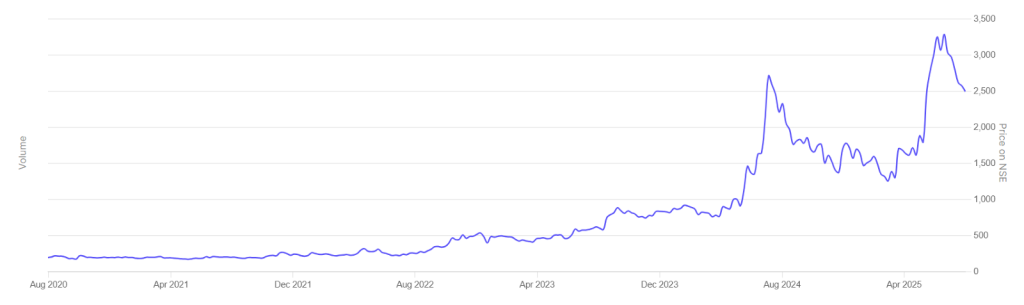

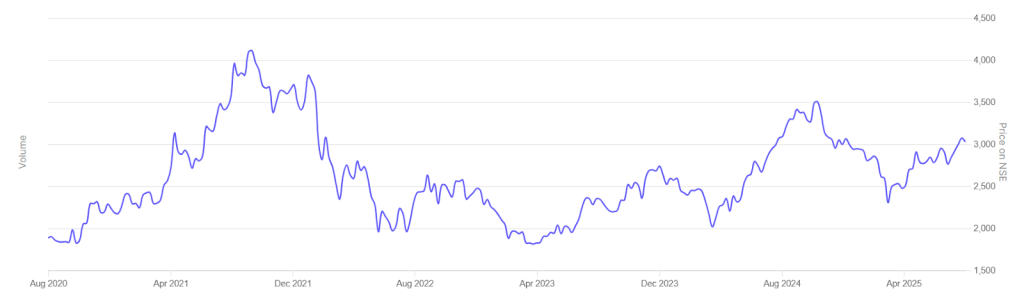

1. CDSL

Central Depository Services (India) Ltd (CDSL) is one of the two central securities depositories in India, providing essential infrastructure for the dematerialization of securities and settlement of trades. With a near-monopoly in the segment and virtually zero debt, CDSL enjoys recurring, highly scalable revenues and high profit margins, making it a robust long-term play in India’s financial infrastructure space.

Company Snapshot

Founded: 1999

Headquarters: Mumbai, Maharashtra

Current MD & CEO: Nehal Vora

Segment: Financial / Depository Services

Fundamentals

- P/E Ratio: 64.35

- Dividend Yield: 0.60%

- Net Profit (Qtr): ₹102.41 Cr

- ROE: 32.68%

- Debt/Equity: 0.00

- 1-Year Return: 31.98%

- ROCE: 41.96%

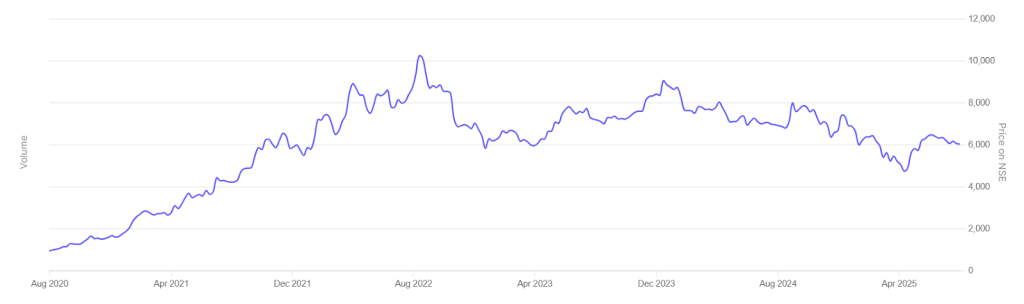

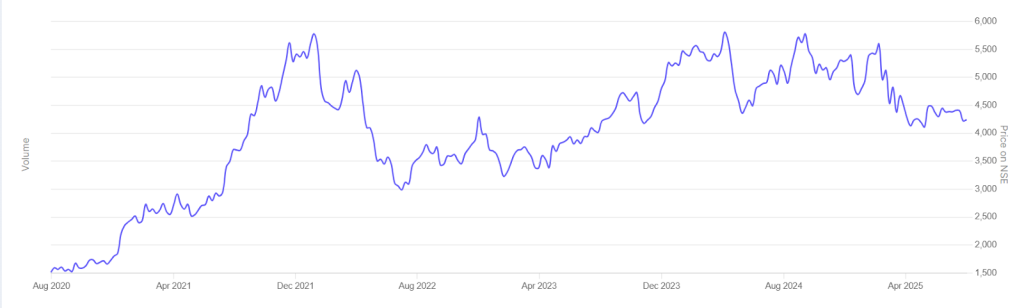

2. Garden Reach Shipbuilders & Engineers (GRSE)

GRSE is a government-owned shipyard engaged in designing and building advanced warships and vessels for the Indian Navy and Coast Guard. With a debt-free balance sheet and growing defence demand, it stands as a strategic PSU in India’s shipbuilding sector.

Company Snapshot

Founded: 1884 (acquired by GoI in 1960)

Headquarters: Kolkata, West Bengal

Current Chairman & MD: Cmde PR Hari

Segment: Defence Shipbuilding & Engineering

Fundamentals

- P/E Ratio: 54.11

- Dividend Yield: 0.36%

- Net Profit (Qtr): ₹244.25 Cr

- ROE: 28.11%

- Debt/Equity: 0.00

- 1-Year Return: 16.34%

- ROCE: 37.28%

3. Tata Elxsi Ltd

Tata Elxsi is a niche IT services company focused on engineering R&D, especially in autonomous vehicles, digital media, and healthcare. Its high-margin model and global clientele make it a specialized tech play within the Tata Group.

Company Snapshot

Founded: 1989

Headquarters: Bengaluru, Karnataka

Current MD & CEO: Manoj Raghavan

Segment: IT Services / Engineering R&D

Fundamentals

- P/E Ratio: 50.37

- Dividend Yield: 1.21%

- Net Profit (Qtr): ₹144.37 Cr

- ROE: 29.27%

- Debt/Equity: 0.07

- 1-Year Return: -12.92%

- ROCE: 36.26%

4. AstraZeneca Pharma India Ltd

AstraZeneca India, the Indian arm of global pharma major AstraZeneca plc, focuses on specialty branded drugs in oncology, cardiovascular, and respiratory segments. It has delivered strong growth while maintaining healthy returns.

Company Snapshot

Founded: 1979

Headquarters: Bengaluru, Karnataka

Current MD: Sanjeev Panchal

Segment: Pharmaceuticals

Fundamentals

- P/E Ratio: 127.44

- Dividend Yield: 0.36%

- Net Profit (Qtr): ₹58.25 Cr

- ROE: 23.63%

- Debt/Equity: 0.05

- 1-Year Return: 23.63%

- ROCE: 33.40%

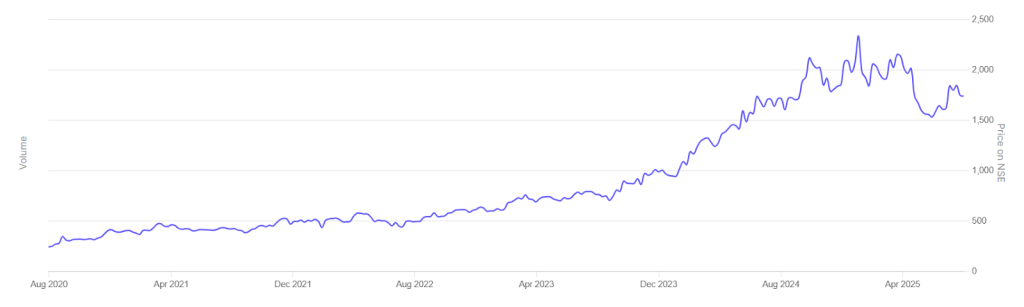

5. Ajanta Pharma Ltd

Ajanta Pharma is known for its branded generics business in India and emerging markets, especially Africa and Asia. Its consistent margins and growth across geographies make it a strong mid-cap pharma pick.

Company Snapshot

Founded: 1973

Headquarters: Mumbai, Maharashtra

Current MD: Yogesh M. Agrawal

Segment: Pharmaceuticals

Fundamentals

- P/E Ratio: 37.03

- Dividend Yield: 1.31%

- Net Profit (Qtr): ₹255.34 Cr

- ROE: 24.91%

- Debt/Equity: 0.01

- 1-Year Return: 15.22%

- ROCE: 32.37%

6. Apar Industries Ltd

Apar Industries operates in specialty conductors, cables, and transformer oils, supplying to global power and infrastructure clients. With strong exports and growing demand, it has become a key player in power transmission.

Company Snapshot

Founded: 1958

Headquarters: Mumbai, Maharashtra

Current CMD: Kushal Desai

Segment: Specialty Conductors & Engineering

Fundamentals

- P/E Ratio: 42.54

- Dividend Yield: 0.56%

- Net Profit (Qtr): ₹249.97 Cr

- ROE: 19.60%

- Debt/Equity: 0.13

- 1-Year Return: 9.53%

- ROCE: 32.09%

7. Hexaware Technologies Ltd

Hexaware offers IT and BPO services, focusing on digital transformation across industries like BFSI, healthcare, and manufacturing. With improving margins and high dividend payouts, it’s a growing mid-tier IT name.

Company Snapshot

Founded: 1990

Headquarters: Mumbai, Maharashtra

Current CEO: R Srikrishna

Segment: IT Services / Software

Fundamentals

- P/E Ratio: 34.02

- Dividend Yield: 0.79%

- Net Profit (Qtr): ₹379.70 Cr

- ROE: 23.29%

- Debt/Equity: 0.10

- 1-Year Return: — (Not provided)

- ROCE: 29.52%

8. Dr. Lal PathLabs Ltd

Dr. Lal PathLabs is a leading diagnostics chain in India, with a strong presence across urban and semi-urban areas. Its asset-light model and high margins make it a strong healthcare service provider.

Company Snapshot

Founded: 1949

Headquarters: New Delhi

Current MD: Dr. Arvind Lal

Segment: Diagnostics & Healthcare Services

Fundamentals

- P/E Ratio: 52.31

- Dividend Yield: 0.77%

- Net Profit (Qtr): ₹155.50 Cr

- ROE: 24.30%

- Debt/Equity: 0.07

- 1-Year Return: -0.05%

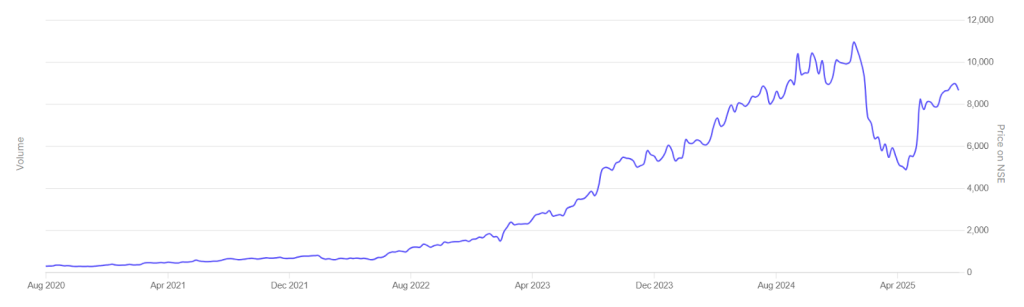

9. L&T Technology Services Ltd (L&T Tech)

L&T Tech is a premium ER&D services company within the L&T Group, catering to automotive, aerospace, industrials, and more. It has a strong global clientele and a well-articulated growth roadmap.

Company Snapshot

Founded: 2012 (subsidiary of L&T Group)

Headquarters: Vadodara, Gujarat

Current CEO: Amit Chadha

Segment: Engineering R&D

Fundamentals

- P/E Ratio: 35.42

- Dividend Yield: 1.27%

- Net Profit (Qtr): ₹316.10 Cr

- ROE: 22.11%

- Debt/Equity: 0.10

- 1-Year Return: -19.05%

- ROCE: 28.29%

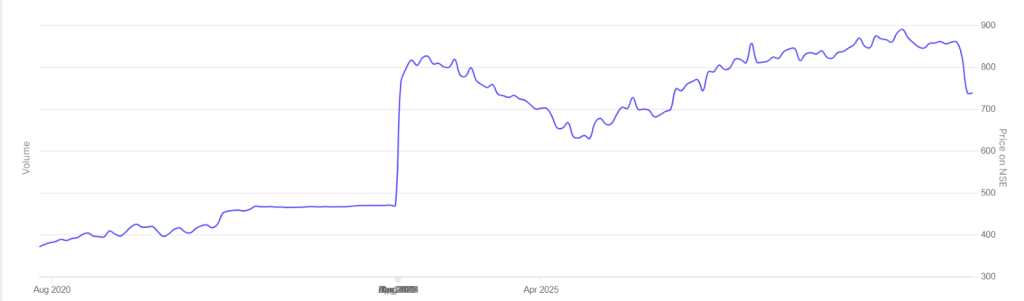

10. Blue Star Ltd

Blue Star is a leading player in cooling and refrigeration, catering to both commercial and consumer markets. It benefits from a strong brand, diverse product portfolio, and post-pandemic demand recovery.

Company Snapshot

Founded: 1943

Headquarters: Mumbai, Maharashtra

Current MD: B. Thiagarajan

Segment: Consumer & Commercial Appliances

Fundamentals

- P/E Ratio: 61.12

- Dividend Yield: 0.52%

- Net Profit (Qtr): ₹194.00 Cr

- ROE: 20.62%

- Debt/Equity: 0.12

- 1-Year Return: 1.97%

- ROCE: 26.20%

Conclusion

Midcap stocks offer a compelling opportunity for long-term investors willing to stomach a bit more volatility for the prospect of superior returns. The companies highlighted above showcase strong financials, future-ready business models, and competent leadership—key ingredients for wealth creation over time.

However, as with any investment, it’s essential to conduct your own due diligence or consult a qualified financial advisor. Market conditions, company-specific developments, and economic changes can all impact performance.

Stay diversified, stay informed, and always invest based on your risk appetite and financial goals.