Retail investors looking for multibagger returns at a cheap entry price have long been drawn to penny stocks. These stocks in India are usually characterized by a modest market capitalization (usually less than Rs. 500 crore) or a low market price (often less than Rs. 100). Though fundamentally risky because of their high volatility, poor liquidity, and lack of transparency, well-chosen penny stocks with solid fundamentals can yield substantial long-term returns.

Ten high-potential penny companies with strong fundamentals, consistent profit growth, low debt, and strong promoter commitment are examined in this extensive guide. These businesses are not just inexpensive; they are also hidden treasures with the potential to grow over time.

How to select the best Penny stock?

To shortlist the best penny stocks for long-term investment in 2025, we used the following filters:

- Stock price under Rs. 100 or market cap under Rs. 600 crore

- P/E ratio under 15

- ROE and ROCE above 15%

- Low or zero debt-to-equity ratio

- Promoter holding above 50%, with no pledging

- Consistent revenue and profit growth over 3–5 years

- Positive net cash flow and asset-light models, where applicable

Top Penny Stocks to Watch

S.No. | Name | Market Cap (₹ Cr) | P/E | ROE (%) | Debt / Eq | ROCE (%) |

1 | International Conveyors Ltd | 562 | 6.1 | 25.6–28.9 | 0.00 | 25.4–29.5 |

2 | Shree Rama Multi-Tech Ltd | 543–547 | 10.62 | 40.13 | 0.25 | 15.13 |

3 | Integrated Industries Ltd | 468 | 8.28 | 32.1 | 0.01 | 30.48 |

4 | Taparia Tools Ltd | 42–43 | 0.35 | 35.6 | 0.01 | 47.9 |

5 | Mahalaxmi Rubtec Ltd | 231–235 | 14 | 27.59 | 0.21 | 30.2 |

6 | Virtual Galaxy Infotech Ltd | 438–443 | 13.7 | 47.74 | 0.43 | 44.99 |

7 | Globe Commercial Ltd | 19–20 | 3.3 | 38.76 | 0.08 | 49.96 |

8 | Syncom Formulations (India) Ltd | 1,731 | 35.18 | 15.60 | 0.01 | 18.66 |

9 | Global Education Ltd | 346 | 13.7 | 27.5 | 0.00 | 35.9 |

10 | Systango Technologies Ltd | 345 | 14.5 | 27.8 | 0.00 | 32.3 |

Deep dive into the Top Penny Stocks

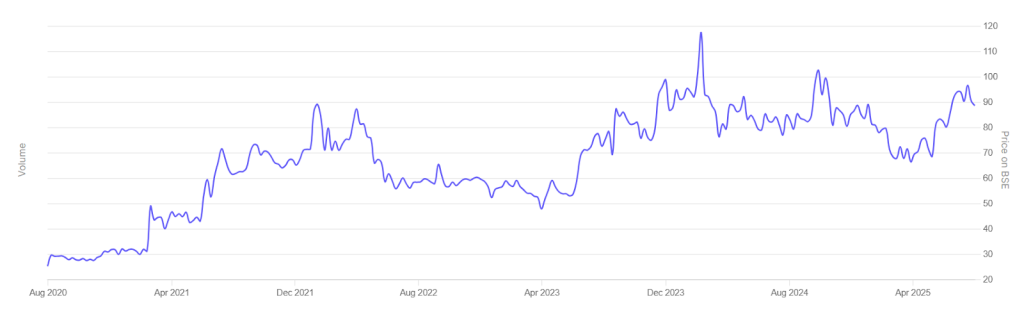

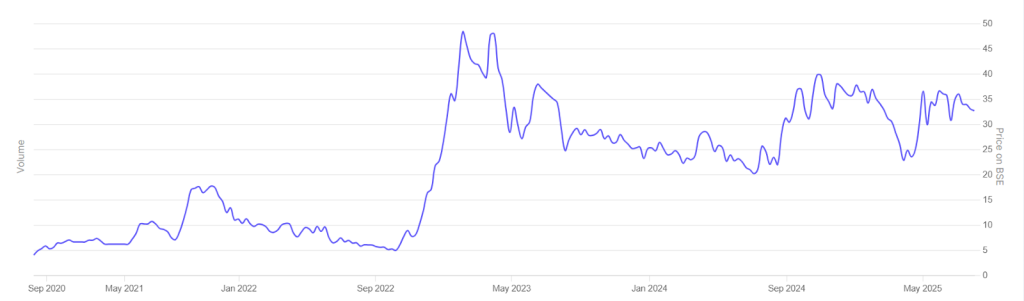

1. International Conveyors Ltd

International Conveyors Limited manufactures and supplies PVC‑reinforced conveyor belts to mining, cement, bulk handling, and steel plants. With nearly 45–50% market share in specialized conveyor segments in India, it occupies a niche with stable order books and recurring revenues.

Fundamentals

- Market Cap: ₹562 Cr

- P/E Ratio: 6.1

- ROE: ~28.9%

- ROCE: ~29.5

Attractive Long-Term Factors

- Undervalued specialty leader: Trades at just ~6× earnings despite strong profitability.

- High capital efficiency: ROCE and ROE in mid‑20s/late‑20s with no debt.

- Niche dominance in industrial belts: Very limited competition domestically.

- Strong promoter alignment: Nearly 70% promoter holding with no pledges indicates confidence.

Risks

- Cyclicality in industrial capex: Slowdowns in cement/mining demand can impact order inflows.

- Concentration risk: Large contracts may skew quarterly performance unpredictably.

- Limited liquidity & coverage: Thin trading volumes; minimal analyst tracking.

Future Outlook

At its current valuation, International Conveyors seems to embed modest growth expectations. If infrastructure and industrial automation continue rising, the company’s niche dominance and conservative balance sheet may support steady long-term compounding. Its low leverage and high promoter conviction offer downside protection in volatile industrial cycles.

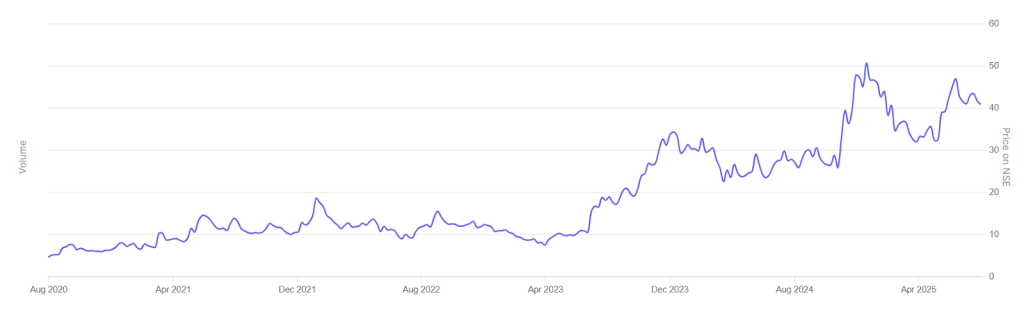

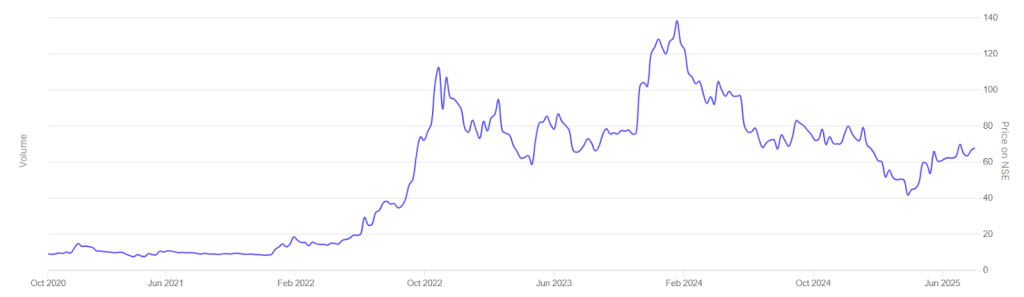

2. Shree Rama Multi‑Tech Ltd

Shree Rama Multi‑Tech Ltd. is a packaging‑materials specialist producing laminated tubes, lamitubes, labels, and flexible packaging films. Based in Ahmedabad, it serves FMCG brands and exports via Japanese/Swiss technical tie‑ups, driving growth.

Fundamentals

- Market Cap: ~₹543–547 Cr

- P/E Ratio: 10.62

- ROE: 40.13

- ROCE: 15.13

- Debt-to-Equity: 0.25

Attractive Long-Term Factors

- High-margin business: ROE over 30% reflects strong profitability.

- Consistent growth via global clients: Premium packaging supplies to FMCG with technical tie‑ups.

- Asset-light operations with disciplined promoters: Low leverage and stable governance.

- Re-rating potential: Modest P/E given strong margins and growth outlook.

Risks

- Volatility in profitability: Historical profit swings (even negative years), contingent liabilities (~₹247 Cr flagged) require caution.

- Raw material and packaging costs: Exposure to plastic/resin price cycles and currency swings for exporters.

- Sector sensitivity: Slowdown in FMCG packaging orders may dent performance.

Future Outlook

As packaging demand stays resilient and export exposure grows, SRMTL may sustain high-margin expansion. If new capacity utilization ramps up, earnings could rerate. Still, due diligence on contingent liabilities and consistent delivery—especially given past profit variability—is essential.

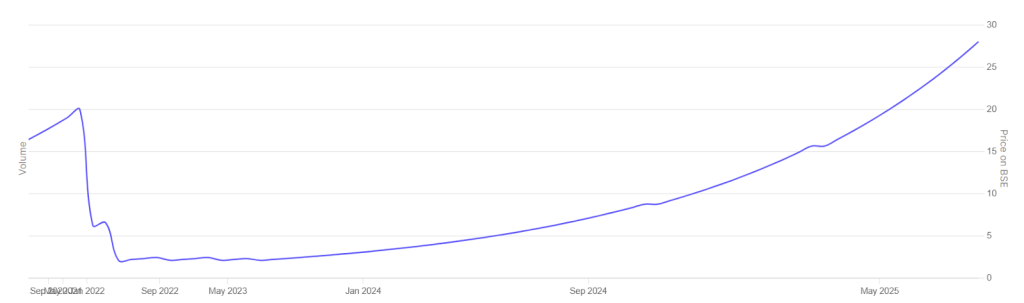

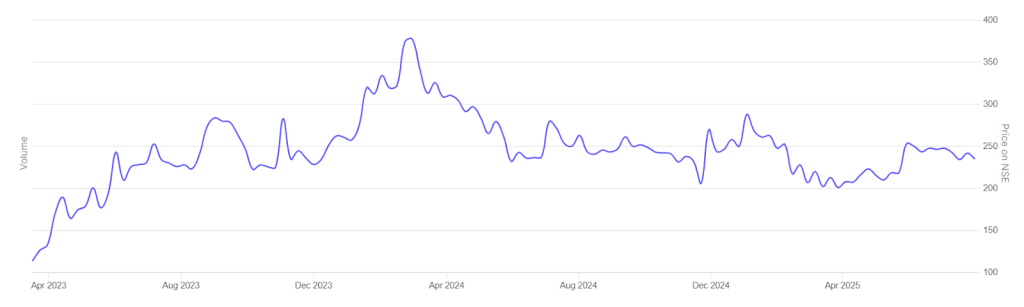

3. Integrated Industries Ltd

Integrated Industries Limited (formerly Integrated Technologies) is a food‑products company, primarily manufacturing processed bakery and confectionery items under its brands. It operates with a capital‑light trade and manufacturing model.

Fundamentals

- Market Cap: ₹468 Cr

- P/E Ratio: 8.28

- ROE: ~32.1%

- ROCE: ~30.48%

- Debt-to-Equity: 0.01

Attractive Long-Term Factors

- Strong earnings efficiency: Mid‑30s ROCE/ROE with minimal leverage.

- Reasonable valuation: Trades at ~8.5× earnings vs broader FMCG valuation cluster.

- Consistent growth: Impressive YoY topline and bottom‑line growth across recent quarters.

- Balanced promoter structure: Reasonable promoter stake with some public float for liquidity.

Risks

- Lower FII/DII presence: Minimal institutional ownership suggests limited visibility.

- Brand and product risk: Consumer-oriented businesses face shifting tastes and competitive pressures.

- Working capital cycle: Potential strain if receivables and inventory management weaken.

Future Outlook

If Integrated continues ramping distribution and scaling both branded and co‑packing lines, earnings could compound at double‑digit rates. Its clean balance sheet and strong margin profile make it a candidate for re-rating as investors discover its business model.

4. Taparia Tools Ltd

Taparia Tools Limited manufactures a wide range of hand tools—spanners, pliers, screwdrivers, hammers, gardening tools, and workshop equipment. A household name among professionals and DIY users, it exports globally while serving domestic industrial clients.

Fundamentals

- Market Cap: ₹42–43 cr

- P/E Ratio: ~0.35

- ROE: ~35.6%

- ROCE: ~47.9%

- Debt-to-Equity: 0.01

Attractive Long-Term Factors

- Deep value opportunity: Ultra-low P/E (~0.35×) suggests heavy undervaluation given cash flows.

- Outstanding capital metrics: ROCE approaching 48% and ROE in mid‑30s, with no debt.

- Legacy brand with export presence: The Taparia brand holds a reputation and international orders.

Risks

- Micro-cap liquidity risk: Extremely small market cap and low volume entail high volatility and poor exit liquidity.

- Industry cyclicality: Demand for non‑branded tools may fluctuate with industrial capex and consumer demand.

- Valuation anomaly risk: Ultra-low P/E could signal stagnation or unreliable earnings.

Future Outlook

If Taparia can grow exports or diversify its product range, even modest increases in scale could trigger valuation rerating. But given its small size and liquidity constraints, it suits high-risk, high-return allocations. A classic hidden asset play—quiet, cash-generative, and potentially misunderstood by broader markets.

5. Mahalaxmi Rubtec Ltd

Mahalaxmi Rubtec Ltd. manufactures traditional textiles, technical textiles, and rubberized textile products, supplying to industries like hoses, conveyor belting, and coated fabrics. Its positioning in niche technical textiles gives it exposure to steady industrial demand.

Fundamentals

- Market Cap: ~₹231–235 Cr

- P/E Ratio: 14

- ROE: 27.59%

- ROCE: ~30.2%

- Debt-to-Equity: 0.21

Attractive Long‑Term Factors

- Strong capital efficiency: ROCE above 30% indicates good profit generation relative to capital employed.

- Debt‑free operations: Zero leverage helps during volatile cycles.

- Niche industrial segment exposure: Technical textiles and rubberized fabrics are often insulated from consumer swings.

- Reasonable valuation: Trades at ~14× earnings with clean fundamentals, compared to peers.

Risks

- Revenue contraction: Negative top-line growth over the past five years suggests stagnation or capacity underutilization.

- Dividend inconsistency: None reported lately, despite profits.

- Limited analyst coverage & transparency: Smaller reporting intensity, potential governance oversight.

Future Outlook

If revenue growth resumes—especially from industrial exports or new contracts—Mahalaxmi Rubtec could see upside in valuation. The combination of high ROCE, debt-free balance sheet, and a recovery in textile demand offers scope for moderate re-rating over time.

6. Virtual Galaxy Infotech Ltd

Virtual Galaxy Infotech Limited is a SaaS-based IT/technology services company, offering core banking solutions, ERP systems, e-governance platforms, and custom software to government agencies, BFSI clients, and SMEs.

Fundamentals

- Market Cap: ~₹438–443 crore

- P/E Ratio: ~13.7

- ROE: 47.74%

- ROCE: 44.99%

- Debt-to-Equity: 0.43

Attractive Long‑Term Factors

- Exceptional return metrics: ROE nearly 50% and ROCE above 44%—indicative of superior profit-per-capital.

- Growth across BFSI and e-governance: Recurring SaaS/tech revenues with scaling potential across digital transformation markets.

- Strong promoter stake and zero debt: Governance alignment and financial conservatism support the investment thesis.

Risks

- High competition in tech services: Larger IT firms or new-age startups may strain margins and client acquisition.

- Client concentration risk: Government or BFSI contracts may be project-based, not long-term recurring.

- Execution risk during scaling: Delivery and talent management could become constraints as the firm grows.

Future Outlook

If Virtual Galaxy can scale its SaaS solutions further into adjacent sectors and expand recurring revenue, current strong metrics could translate into durable EPS growth and potential rerating. As India’s digital infrastructure grows, the firm may carve out a credible long-term role among SMB/e-governance tech providers.

7. Globe Commercial Ltd

Globe Commercial Ltd. specializes in packaging machinery and turnkey solutions, primarily for food, pharmaceutical, and FMCG industries. It is almost debt-free and has delivered robust profit growth over recent years.

Fundamentals

- Market Cap: ~₹19–20 cr

- P/E Ratio: ~3.3

- ROE: 38.76%

- ROCE: 49.96%

- Debt-to-Equity: ~0.08

Attractive Long‑Term Factors

- Extremely high return ratios: ROCE and ROE both north of 40–49%, reflecting capital efficiency and healthy margins.

- Deep undervaluation: At ~3× earnings, pricing may not reflect growth and quality.

- Debt-free and strong operating track record despite small scale.

Risks

- Tiny promoter stake: Only ~8% promoters hold, raising concerns about governance and possible dilution.

- Micro-cap extreme liquidity risk: Very low trade volumes; price swings likely in either direction.

- One or two clients can swing performance: High concentration risk in revenue streams.

- Lack of dividend payout and scant disclosures.

Future Outlook

If Globe Commercial can attract institutional interest or boost scale via exports or multiple clients, rerating from its current deeply discounted P/E is possible. However, governance and liquidity issues make this a highly speculative micro‑cap play—suitable only for cautious exposure in small‑cap/A‑stock buckets.

8. Syncom Formulations (India) Ltd

Syncom Formulations Ltd. operates in pharmaceuticals—manufacturing APIs, intermediates, and formulations, also engaging in trading and property leasing. Despite its low stock price, the company shows solid profit growth and favorable margins.

Fundamentals

- Market Cap: ~₹1,731 Cr

- P/E Ratio: 35.18

- ROE: 15.60%

- ROCE: 18.66%

- Debt-to-Equity: 0.01

Attractive Long-Term Factors

- Low P/E relative to pharma peers: At ~5, the company is deeply undervalued if earnings stabilize.

- Cash-generative business with proven profitability: Consistent profit even with revenue fluctuations.

- Potential upside in API/contract pharma extraction or export-led volume growth.

Risks

- Negative sales trends and stretched working capital cycle: Significant receivable cycles may affect cash flow.

- Low ROE (~11–12%) compared to other penny picks with superior metrics.

- Governance and transparency concerns: No dividends, limited public data.

- Intrinsic valuation suggests overvaluation at current price (~₹14.9 vs ₹18), implying possible downside.

Future Outlook

If Syncom tightens its receivables and returns to growth in APIs or formulations—especially export markets—it might unlock value. But current stretched working capital, lower margins, and valuation discrepancy suggest a cautious stance, even in a recovery scenario.

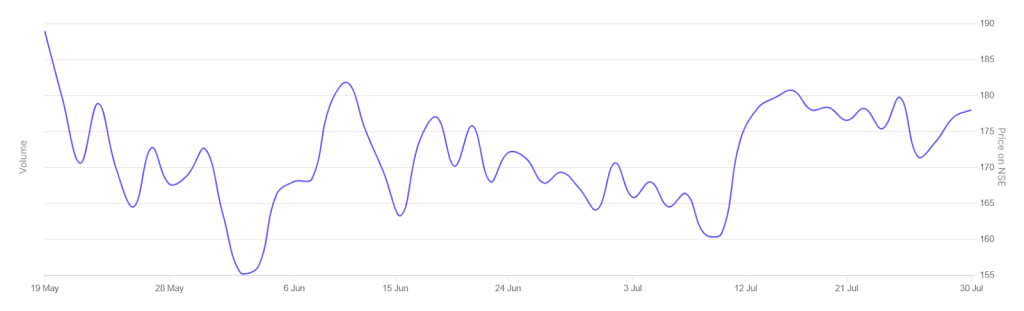

9. Global Education Ltd

Global Education Ltd is a specialized education service provider that offers training, development, and consultancy services. The company partners with universities and educational institutions to deliver content, testing, and training in high-demand vocational areas.

Fundamentals

- Market Cap: ₹346 Cr

- P/E Ratio: 13.7

- ROE: 27.5%

- ROCE: 35.9%

- Debt-to-Equity: 0.00

Attractive Long-Term Factors

- High capital efficiency and zero debt.

- Consistent demand for vocational and skill-based education.

- The government’s push for digital and vocational training benefits its business model.

Risks

- Regulatory shifts in education policy can impact partnerships.

- Competition from ed-tech and online platforms.

Future Outlook

With strong financial metrics and growing demand for skill-based education, Global Education is well-positioned to benefit from India’s vocational training drive. Its asset-light model, solid promoter backing, and zero debt add to its attractiveness

10. Systango Technologies Ltd

Systango Technologies is a tech solutions company specializing in digital transformation, app development, cloud consulting, and blockchain-based platforms. The company operates globally, serving startups to Fortune 500 companies.

Fundamentals

- Market Cap: ₹345 Cr

- P/E Ratio: 14.5

- ROE: 27.8%

- ROCE: 32.3%

- Debt-to-Equity: 0.00

Attractive Long-Term Factors

- Strong global clientele in emerging tech domains.

- Impressive profitability and efficient capital use.

- High promoter confidence and zero leverage.

Risks

- High dependence on client acquisition in saturated markets.

- Currency volatility due to export exposure.

Future Outlook

Systango’s niche in blockchain and enterprise-grade digital services positions it for strong long-term growth. If execution continues at current levels, a valuation re-rating is possible.

Conclusion

Although penny stocks have the potential to yield exponential gains, it is important to carefully include them in a long-term, diversified portfolio. International Conveyors, Sh Rama Multi-Tech, Integral Industries, Taparia Tools, Globe Commercial, Virtual Galaxy, Global Education, Systango Technologies, Mahalaxmi Rubtec, and Syncom Formulations were the ten stocks that stood out for the following reasons:

- Strong metrics: ROCE/ROE over 15–30%, low P/E ratios, minimal debt

- Consistent top and bottom‑line growth over the past quarters/years

- Strong promoter alignment and acceptable liquidity profile

However, these selections are only appropriate for disciplined, risk-tolerant investors who can tolerate volatility in exchange for a possible compounding payout due to their speculative character, liquidity issues, and event risks. Avoid over-positioning and always pair such choices with larger-cap anchor stocks. Quarterly evaluations and routine re-screening are crucial.